Tax advisory services basically means guiding an entity about the specific industry transactions to check the applicability of Tax. If an entity has transactions with multiple products, services, multiple locations and branches, transaction advisory services come in handy. Our professionals at New Gate provide assistance in understanding the scope and effects of Tax in a business entity with their extensive knowledge of the government tax laws and regulations.

- Tax planning, corporate tax consulting

- VAT Tax Registration

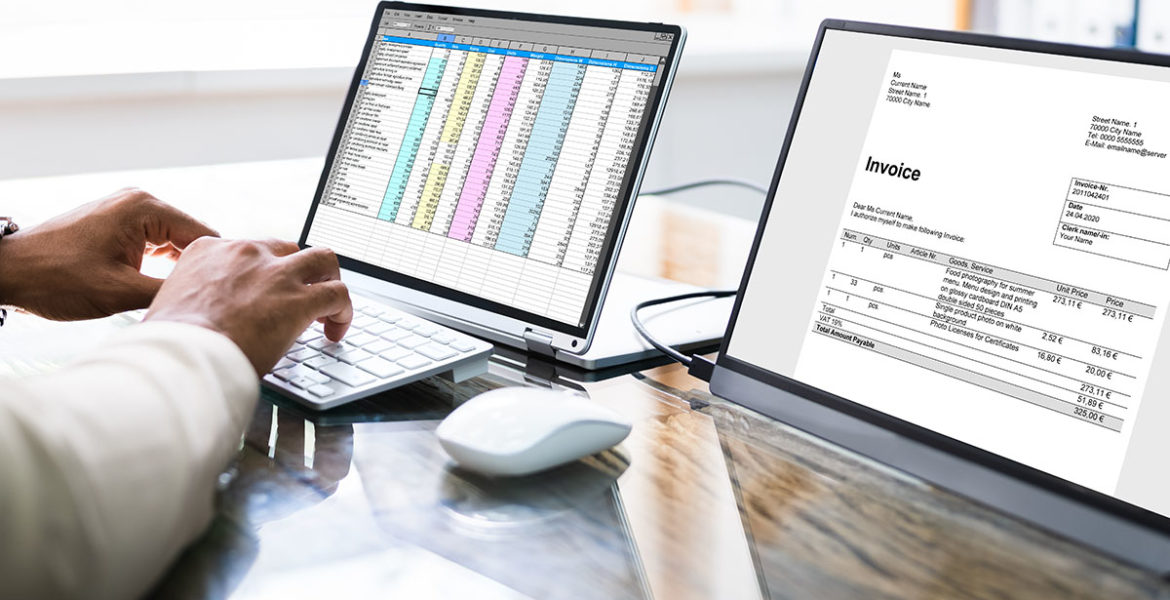

- VAT Preparation and review of tax returns for corporate tax

- Tax card renewal

- Tax classification recommendations

- Tax return preparation

- Salary tax, Payroll processing

- Withholding tax, stamp tax and social insurance.

- Representation at tax inspections process

- Attendance of Internal and Appeal Committee meetings on client’s behalf

- Advising on all tax inspection reports

- Advising and supporting on Electronic Invoice